Anti-Money laundering solution «AML Insighter»

Financial monitoring system «AML Insighter» is the solution for banking sector that supports all major components of anti-money laundering process, tax reducing and prevention of terrorism financing.

The automated financial monitoring system «AML Insighter» helps to implement not only the requirements of mandatory but also the internal financial monitoring as well as to solve the tasks of:

- following the regulatory requirements;

- selection and analysis of financial transactions

- monitoring of customers and transactions,mandatory and internal

- Know your customer (KYC) policy implementation

- quarterly analysis of customersand risk scoring to monitor suspicious activity

- risk level assignment to the customer

- risk level assignment to the branch of the bank

- risk level assignment to bank in general

- case management

- statistical reports compilation

Main functions of financial monitoring system:

- Making rules to select financial transactions subject to mandatory and internal financial monitoring.

- Transaction selection and keeping the register by running selected group of rules.

- Filesharing allows controlling all incoming and outgoing files via unified interface.

- Client Management allows getting detailed information on a customer with a possibility to visualize related statistic connections and operational activity of a customer.

- Customer’s activity quarterly analysis runs on controlled scoring model and helps to detect customers with suspicious behaviour.

- Incidents investigation management.

- Identification monitoring for finding customers’ dataanomalies, which often are affiliated entities or persons trying to avoid identification.

- Information audit based on internal “black lists” as well as on data from authority (DSFMU) using powerful probabilistic and phonetic algorithms.

- System administration (directories and users management, system constant settings).

- Reporting (questionnaires and operations registrygeneration, 200/201 reporting forms, D0/D1files).

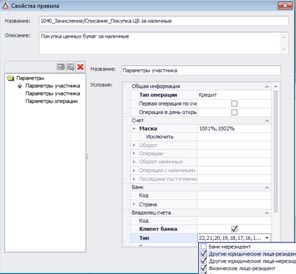

How to create a rule to detect operations, subject to financial monitoring

Rules to detect operations are set in constructor of rules. User sets parameters or their combination in constructorto detect operations according to these parameters and mandatory or internal monitoring attributes, whichmatch the rule. This rule can be launched from the search interface and see if operations are detected correctly. In case operations are the subject to financial monitoring they can be moved in to register for further processing and reporting to authority. Example of interface:

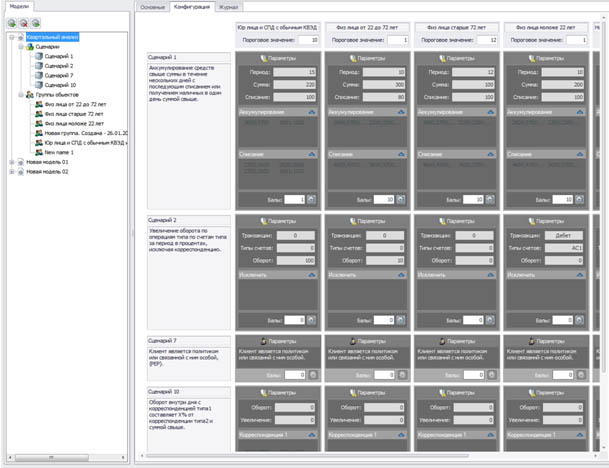

How does the scoring and assignment a customer risk level work?

A scoring model is set within the system to assign a customer risk level with regards to money laundering and terrorism financing. The model includes segmentation of customersaccording to their types, turnovers, etc. imposed on suspicious activity scenarios. Risk level is defined with points. A customer is added points of a scenario of suspicious behaviour if he/she hits such scenario. All points are sumed up at the end and we receive a customer risk level. Example of interface:

System architecture

The system includes data syncronization server, information supporting financial monitoring process database and SAFM workstation.

For more details please check out presentation of the product or contact us.

Presentation in PDF here: Download

Presentation in PPS here: Download